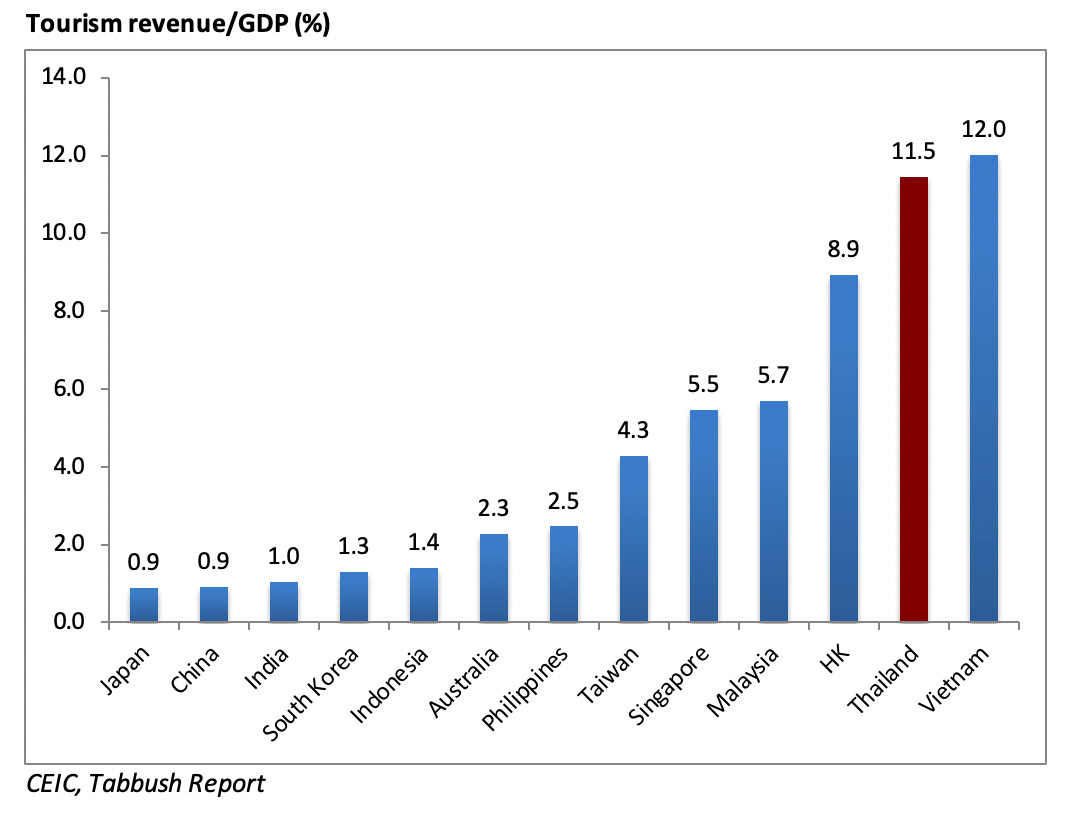

There are few countries that compare with Thailand, in terms of the importance of tourism revenue to GDP. We are also doubtful that the official figures from FY19 truly capture all tourism data. There will be plenty that is cash-based and in the underground economy. Even on stated data, Thailand’s tourism revenue of USD62.3bn during FY19 is 11.5% of nominal GDP. This compares with 2.9% on average for many countries in the region.

The Thai Government is now indicating that by 1 October or 15 October, the country will re-open Bangkok and many other provinces, to foreign tourists who have been inoculated and without onerous restrictions. This may mean that travelers can fly into Bangkok, travel freely anywhere in the province, sight-seeing, shopping, dining, et al. After 7 days and a virus test, they are then free to travel anywhere in the country. We expect details to emerge in coming days, where it will gradually become clearer, that Thailand is essentially re-opening.

Banks are incredibly exposed to tourism naturally, as they are the lenders to the Thai economy, with a less developed capital market than in many other countries. Kasikornbank (KBANK) has about 33% of its loans to the SME segment, where we believe there should be considerable concentration directly or indirectly to tourism. Some large peer banks hardly compare at about half this level. And this may be one reason that KBANK saw a more aggressive decline in credit costs during recent quarters and during 1H21.

The decline in credit costs is not a theme that has run its course in Thailand. During 2Q21, total impairment costs for Thai banks rose on aggregate. As credit metrics improve, estimates of expected credit losses (ECL) will also improve, driving impairment costs lower. But for us this is only one positive aspect of the Thai bank story. Where this occurs alongside improving loan volume, improving net interest margins, and with reasonable or high dividend yields, Thai banks look especially interesting.

Tisco Financial Group (TISCO) and TCAP Holdings (TCAP) are two that come to mind, which are much smaller banks by assets, and lessor followed banks than the largest 5 banks. And these banks also stand to benefit, if not better than many of the largest banks, while their dividend yields are amongst the highest of Asia’s banks.

Where Thailand typically receives about 40m annual visitors and has a population of 70m persons, the impact to the economy, and banks indirectly, can be exaggerated. Where the base at present in incredibly low for tourism revenue, this can make the delta especially strong. Banks remain the most leveraged sector to the Thai economy, where a multi-faceted earnings improvement can put their profit delta and overall returns at the fore.

Our paid subscription product offers analyst meetings, spreadsheets, bespoke research, and in-depth thematic and company reports. At present we are offering Substack research at no charge by way of introduction. Contact us on info@tabbushreport.com to discuss package pricing and details or learn more on www.tabbushreport.com .