Credit metrics are far worse today than yesterday for China property developers due to stresses at China Evergrande. About half of the developer’s debt are supplier credit, not traditional bank loans. This has wide-reaching implications for credit metrics at related SMEs. While all eyes are on the domestic lenders and their exposure to China Evergrande, here we focus elsewhere.

We look at Hong Kong’s Bank of East Asia and Hang Seng Bank. We believe that the rigor of their reporting may allow for better flow through to numbers, than perhaps with wholly domestic banks. Having said this, China Merchants Bank provides incredible disclosure during 1H21, suggestive of what we are now seeing.

Banks must assess their expected credit losses (ECL) based on the probability of default (PD) and loss given default (LGD) of borrowers. This is under relatively new accounting regulations. It is unlike in the past, where banks take provisioning based how late the payments on their loans may be. With the clear financial strains of China Evergrande now and the likely flow-through to supplier SMEs, banks in theory will be forced to re-evaluate their PD and LGD on these exposures.

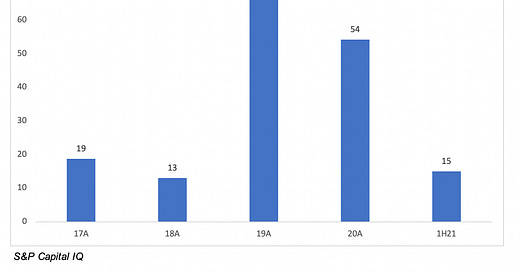

Bank of East Asia (BEA) has more Mainland China exposure than most any other bank in Hong Kong, at 50% of loans. It already reported meaningful deterioration in credit metrics in China property during FY19 when its credit costs rose to 1.44% of loans from 0.24% in the preceding year. During FY20 the figure moved lower to 0.93% of loans but the figure is far higher than the 10-20bps seen annually some years ago. And this is where they moved to during 1H21, to 21bps.

We believe that even the current figures can see a substantial increase later this year given events transpiring at present. BEA is now at pre-crisis benign credit costs/operating profit, at only 15%. When we understand that its collateral coverage is only 25% on China loans compared with 70% for its Hong Kong loans, the risk of meaningful impairments, credit costs, is significant.

Hang Seng Bank (HSB) is perhaps more interesting. While its Mainland China exposure is far lower, at 21% of loans, its credit cost delta can be significant. The bank opted to book only HKD349m in total impairment costs during 1H21. The figure was HKD978m in the preceding interim period, and it was HKD1,760m in 1H20. We know from previous cycles that impairment cost growth can be exponential when credit metrics deteriorate dramatically. HSB reported a 5.3x increase in annual impairment costs in FY08 and 6.1x in FY14. The bank’s 64% decline in 1H21 interim impairment costs, sets it up for a sizable delta in 2H21 and perhaps beyond.

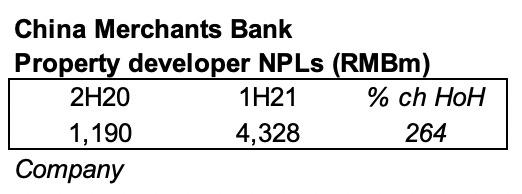

It is also telling, that China Merchants Bank reported a major rise in its property developer bad loans even before the current stresses of China Evergrande. The bank saw its bad loans to property developers rise from RMB1.2bn to RMB4.3bn from 2H20 to 1H21. The China bank further reports significant deterioration in its off-balance sheet, an area of financial statement analysis that is often overlooked. This may be one area that SME stresses become clearer even before being visible in reported NPL figures. To us this type of clarity in credit metrics is more of the exception than the norm in China banking. We continue to look toward banks in Hong Kong, Singapore or to HSBC, for a more lucid view on China credit metrics.

Contact us on info@tabbushreport.com about our paid subscription product, which includes analyst access, in-depth reports, bespoke research and spreadsheets. Learn more on www.tabbushreport.com