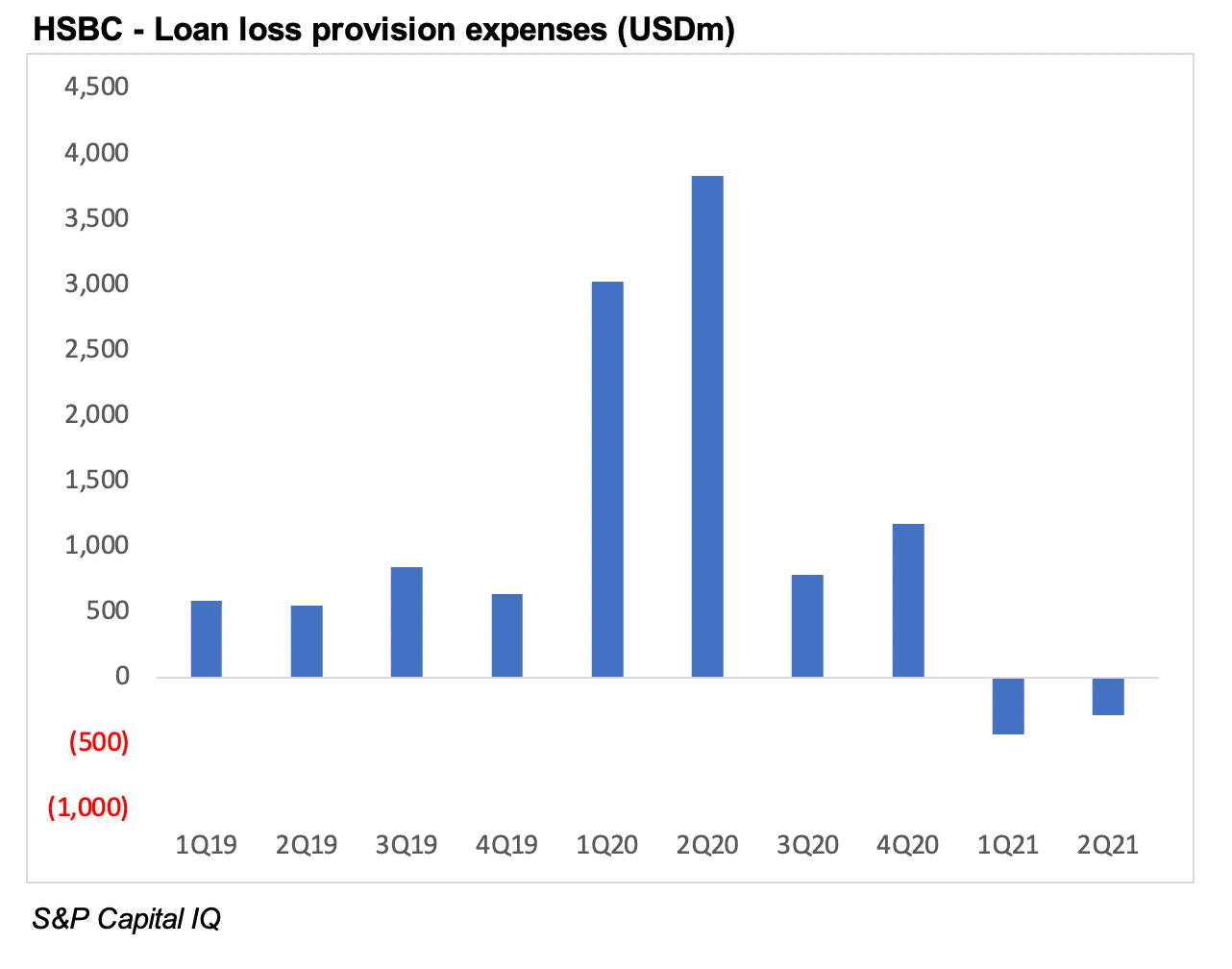

A relatively long-term look at HSBC’s ROA suggests the bank is more or less at a normalized level. The risk now is that worsening credit metrics in China property cause probability of default (PD) and loss given default (LGD) estimates to rise. This in turn should drive higher loan loss provision expenses (LLP). It is also notable that the bank’s provision reversals in 1Q21 already dropped by 35% in 2Q21. We wonder if the swing upward in 3Q21 will be far more sharp?

We doubt that most are aware of HSBC’s high pace of growth in China property development loans. Over the past 3 years, the bank which had prided itself on its Scottish conservatism, saw these loans rise from USD4.4bn to USD6.3bn. It is not easy to find any other segment in any region matching this sort of growth rate, up 43% over the period.

If there were a marked buildup in loan loss reserves (LLR) for these loans, this would be less of a concern. There is almost no LLR for these loans. The bank holds only USD23m in LLR for its China property development loans. Its ratio of LLR to loans in this segment and region is one of the lowest, and well lower than its total LLR allowance for wholesale loans or for personal loans.

HSBC saw its LLR decline at the group level by USD1.6bn in 1H21 compared with FY20. This is likely due to write-offs. But what matters is that as credit metrics worsen in China property, where loans are up considerably in recent years, and therefore ‘unseasoned’, there is increased risk of more LLR being required for these loans. Where HSBC saw its credit costs at negative USD284m during 2Q21, the delta in credit costs in 3Q21 or/and 4Q21, can be a shock to the market. Even during a very normal FY19, the bank saw quarterly loan loss provision expenses at USD656m per quarter. If reverting back to this quarterly level, that can mean a negative USD1bn profit delta.

This would not be the first time that HSBC grossly under-estimated credit risk with Household International the most obvious recent example. (This was later named HSBC Finance). At the same time, HSBC holds a sizable off-balance sheet, which can also lead to impairment costs; this is another area that can be a major surprise. It is in times of corporate distress when lines are drawn down just as financial ratios and credit metrics worsen. There is increased marginal risk here for HSBC, which may mean our above analysis is conservative. Where China Merchants Bank hardly operates on the same scale as HSBC, even this smaller bank reveals clear deterioration in its contingent liabilities - and yet this was before recent stresses.

At present we are providing Substack research on a complimentary basis, which will not last and is clearly not a viable long-term business model. Our premium product includes in-depth company and sector reports, analyst access, bespoke research and spreadsheets. Contact us on info@tabbushreport.com or see www.tabbushreport.com to learn more.