Thailand’s Tisco Financial Group (TISCO) remains one of the more interesting bank stories in Asia-Pacific. While we tend to focus on asset quality and the delta in credit costs, a puritanical focus here can miss other opportunities. For this relatively small Thai bank, the story is more about asset-liability management (ALM), and to a degree, dividend yield.

TISCO has a high level of term deposits at 72% of total deposits as at 1H21. This is wholly dissimilar from typical commercial banks, where large Thai peers will have term deposits at around 20-40% of total deposits. While higher current and savings accounts (CASA) can support margins due to lower funding costs, what matters now is the delta. Any bank that has had and continues to have low term deposits, will have already seen their funding costs gradually move lower. But term deposits will take 3-12 months to mature, and it will only be after these deposits mature and re-price, that the lower interest rate environment will work through to lower funding costs.

Kasikornbank (KBANK), the largest Thai bank with the least amount of term deposits, at 19.6% of total as at 2Q21, is illustrative. KBANK saw its funding costs come down from 1.23% to 0.59%, from FY19 to 1H21. With concurrent pressure on asset yields over this time, its net interest margins declined from 3.59% to 3.45%. TISCO is a very different story. Its funding costs declined from 2.11% to 1.16% over this same period but with NIM expanding, from 4.51% to 5.02%.

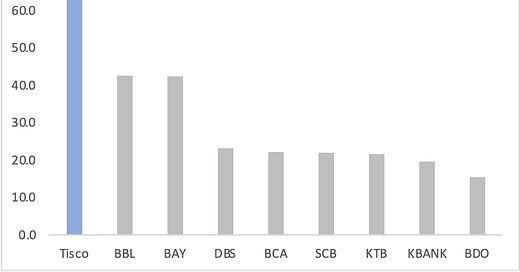

Selected Thai and Asean banks – Term deposits/total deposits (%)

S&P Capital IQ, Note: As at 2Q21 or most recently populated period

Of course, there are other factors at work that support margins at TISCO, but the ability to see nearly ¾ of total deposits re-price at far lower rates, should continue to support NIM expansion in coming quarters. TISCO also benefits from its ability to manage its funding downward by a greater magnitude than its loans. This will inherently support net interest income and NIM, as it means less liabilities to pay for, at the margin. TISCO’s loan-to-deposit ratio (LDR) is now at 111% as at 1H21 from 105% as at FY20. KBANK’s LDR is 90% and has been relatively stable over this same period.

TISCO has actively sought to lower its wholesale funding in favor of traditional deposits. Its non-deposit funding has come down from THB68bn to THB15bn from FY15 to 1H21. These debt borrowings had been equivalent to 40.9% of deposits in FY15; as at 1H21 they are equivalent to 8.5% of deposits. ALM is at the core of banking, and if effective, it can have sizeable benefits to returns. Over this same time period, TISCO saw its ROA rise from 1.44% to 2.57%. There are few banks in Asia-Pacific that have had such a positive profit transformation - and including 1H21.

TISCO – ROA (%)

S&P Capital IQ

We would not expect a similarly high rate of LDR expansion for TISCO in coming quarters. But even if maintained at around these levels, it is generally a net positive for margins and net interest income; as it means there is more leverage to loan income compared with funding costs. As an aside, we note that TISCO holds THB38bn in equity, so that its LDR which is over 100% does not mean the bank is beholden to high levels of wholesale funding; it’s lending capital. Its loans of THB214bn are well funded by deposits and capital combined of THB219bn.

Stability of loan yields is another critical point favoring TISCO relative to many others in Thailand and in Asia-Pacific. The bank has a high level of consumer loans which are fixed rate. This is what one wants to look for in a bank as interest rates fall. TISCO saw its loan yields down 26bps during 1H21 compared with a 42bps decline in funding costs. This positive divergence can continue as term deposits re-price at far lower rates in coming quarters. What is especially interesting is to note the quarterly rise in loan yields together with funding costs in decline. We are not certain that loan yields will continue to rise, but loan mix changes and improved risk-based pricing, can support this – even against the backdrop of stable Bank of Thailand (BOT) policy rates.

TISCO – Funding costs and margins (%)

S&P Capital IQ

At the margin, TISCO is increasing its CASA accounts and decreasing its fixed deposits. During 2Q21, its current accounts rose 9.4% QoQ, while its savings accounts rose 3.5% QoQ. Over the same quarter, the bank’s fixed deposits contracted by 12.5% QoQ. Where this latter figure is far larger in absolute terms, the higher percentage decline is especially meaningful. This should feed through to better funding costs during coming quarters, as the lower term deposit balance as at the end of 2Q21 works through the income statement. A re-pricing of the remaining term deposits at far lower rates should amplify the improvement in overall funding costs.

TISCO also stands out with a high dividend yield unlike most all other banks in Thailand and Asia. The bank paid dividends of THB7.75 per share during 1Q20 and THB6.30 per share during 1Q21. Our data provider puts its dividend yield at 6.8%. This compares with 1.6% on average for the largest three Thai banks. With what appears to be a strongly improved core earnings profile, there is likely more positive risk to dividends, than negative risk. We also note that this dividend yield compares with 0.375% for 3-month deposit rates and 0.50% for the BOT policy rate.

To learn more about our bank research and consultancy see www.tabbushreport.com where we offer bespoke product, analyst access, spreadsheets and meetings. Or contact us on info@tabbushreport.com.